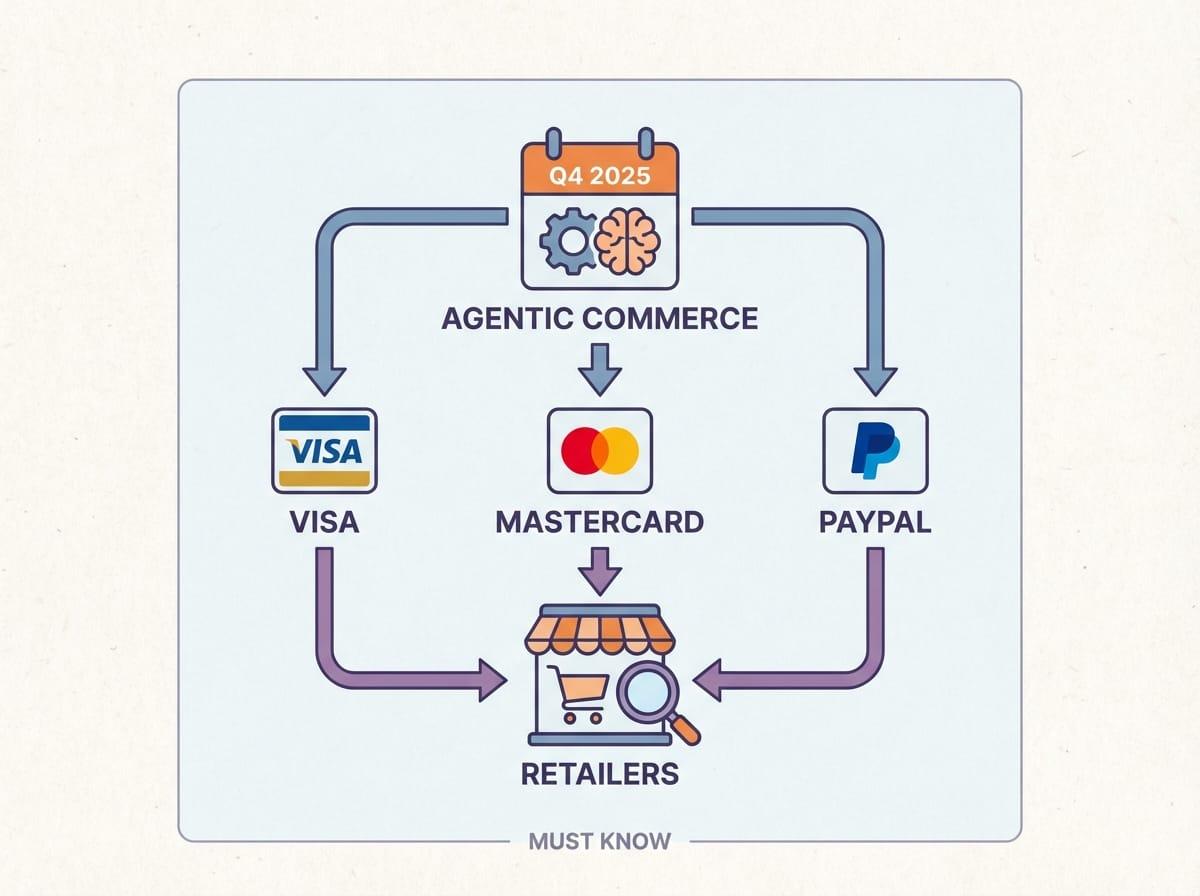

Visa, Mastercard, and PayPal's Q4 2025 Moves Into Agentic Commerce: What Retailers Must Know

On September 29, 2025, Mastercard completed the first live agentic payment transaction. Not a pilot. Not a simulation. An actual AI agent purchased a product using a tokenized credential, fundamentally changing what's possible in commerce. Two weeks later, Visa launched its Trusted Agent Protocol on GitHub. PayPal, meanwhile, partnered with three different AI platforms in three months. The payment networks aren't waiting for agentic commerce to arrive. They're building it.

TL;DR: Visa, Mastercard, and PayPal all made major agentic commerce plays in Q4 2025. Visa launched the Trusted Agent Protocol with partners including Shopify, Stripe, and five major AI platforms. Mastercard processed the first real agentic transaction using digital tokenization. PayPal is everywhere at once: ChatGPT, Perplexity, and Mastercard Agent Pay. With AI agent traffic up 805% on Black Friday and $67 billion in AI-influenced Cyber Week sales, retailers without payment network integration strategies are already behind.

Why Are Payment Networks Racing Into Agentic Commerce?

The payment networks are making aggressive moves because the data is impossible to ignore. AI agent traffic surged 805% year-over-year on Black Friday 2025, according to Adobe Analytics. AI agents influenced $67 billion in global Cyber Week sales—that's 20% of all orders, per Salesforce.

The performance gap between AI-enabled and AI-absent retailers is stark. Retailers with AI agents saw 13% sales growth during Cyber Week, while those without managed just 2%—a 7x difference, according to Salesforce. And 97% of large U.S. retailers already used AI for the 2025 holiday season, per FedEx.

Key Stat: McKinsey projects $1 trillion in U.S. B2C agentic commerce revenue by 2030. The payment networks aren't building for speculation—they're building for a market that's already forming.

What Is Visa's Trusted Agent Protocol?

Visa's Trusted Agent Protocol establishes a foundational framework for secure communication between AI agents and merchants during every step of a transaction. Launched in October 2025, the protocol is now available on GitHub and the Visa Developer Center.

The protocol addresses three critical areas:

| Component | What It Does |

|---|---|

| Agent Intent | Indicates that an agent is trusted with intent to retrieve or purchase a specific product |

| Consumer Recognition | Signals whether a consumer has an existing account or prior interaction with the merchant |

| Payment Information | Enables agents to carry payment data supporting merchant checkout preferences |

Commerce Partners: Microsoft, Nuvei, Shopify, Stripe, and Worldpay have committed to the protocol.

AI Platform Partners: Anthropic, Microsoft, Mistral, OpenAI, and Perplexity are integrating the standard.

Every request from a trusted agent is cryptographically locked to a merchant's specific website and the exact page the agent is interacting with. This prevents authorization misuse. Each signature includes time-sensitive elements ensuring requests are fresh and valid only for single use.

Visa built the protocol upon HTTP Message Signature standards and aligned it with WebAuthn, enabling merchants and agents to establish trust using existing web infrastructure with minimal UX changes required.

"As agentic commerce continues to rise, we recognize that consumer trust is still in its early stages. That's why our focus through 2025 is on building foundational credibility and demonstrating real-world value." — Visa representative

How Does Mastercard Agent Pay Actually Work?

Mastercard Agent Pay uses digital tokenization to enable AI agents to transact safely and transparently on behalf of consumers. The system generates 16-digit tokens connected to original payment cards, allowing users to set spending parameters and control which purchases agents can authorize.

The milestone transaction occurred on September 29, 2025, when PayOS and Mastercard completed the first live agentic payment using a Mastercard Agentic Token. This wasn't a demo—it was a real purchase that shifted agentic commerce from theory to practice.

How the Security Framework Works:

- Agent Registration: AI agents are registered and verified before transacting on the Mastercard network

- Unique Identification: Each agent receives unique identification enabling transaction initiation

- Agentic Tokens: Dynamic, cryptographically secure credentials ensure every transaction is traceable and authenticated

- Consumer Control: Users maintain complete control over what agents can purchase

By mid-November 2025, all U.S. Mastercard cardholders were enabled for Agent Pay transactions, with global cardholders following shortly after. Citi and US Bank cardholders were among the first enabled.

The technology integrates with PayPal wallets, creating a multi-layered approach to agentic payments. Mastercard is also collaborating with Microsoft on new use cases, partnering with IBM on B2B applications, and working with acquirers like Braintree and Checkout.com to enhance tokenization capabilities.

What Is PayPal's Multi-Platform Strategy?

PayPal isn't betting on a single AI platform—they're everywhere. In Q4 2025, PayPal integrated with ChatGPT, Perplexity, and Mastercard Agent Pay simultaneously, positioning themselves as the payment layer for agentic commerce regardless of which AI platform wins.

ChatGPT Integration (Agentic Commerce Protocol)

PayPal adopted the Agentic Commerce Protocol (ACP) to embed payments directly within ChatGPT. Through this integration, ChatGPT users can make purchases using their PayPal accounts without leaving the conversation. Starting in 2026, PayPal users will be able to buy items and PayPal merchants will be able to sell through ChatGPT, according to PayPal's announcement.

Perplexity Instant Buy

On November 25, 2025, PayPal and Perplexity launched Instant Buy, enabling checkout directly within Perplexity's chat interface. The integration supports 6,000+ merchants through BigCommerce, Shopware, and Wix, including Wayfair, Abercrombie & Fitch, Ashley Furniture, Fabletics, Adorama, and Newegg.

Mastercard Agent Pay Integration

PayPal tokens can now be used within Mastercard's agentic framework, creating interoperability between the two payment systems for AI-driven transactions.

Agent Ready and Store Sync

PayPal also unveiled two tools designed for merchants: Agent Ready enables existing PayPal merchants to accept AI-based payments instantly across conversational and browser-integrated experiences, featuring fraud protection and zero technical setup. Store Sync ensures product catalogs are discoverable by AI agents.

Key Stat: PayPal's multi-platform approach gives them access to 430+ million active accounts across approximately 200 markets—positioning them to capture agentic commerce transactions regardless of which AI platform a consumer uses.

What Do These Payment Network Moves Mean for Retailers?

The payment networks are building the infrastructure for a commerce model where AI agents—not humans—initiate transactions. This has immediate implications for every retailer.

The Competitive FOMO Is Real

While you're reading this, Walmart is processing ChatGPT Instant Checkout transactions. Etsy sellers are integrated with ACP. Shopify merchants are onboarding to Visa's Trusted Agent Protocol. Target has a custom ChatGPT app in beta.

Retailers without AI agent integration strategies are becoming invisible to a rapidly growing segment of commerce. AI agent referral traffic is still under 1% of total traffic, but it's the fastest-growing category—and the purchase intent is dramatically higher.

The Protocol Fragmentation Challenge

Three major frameworks now compete for retailer attention:

| Protocol | Backers | Best For |

|---|---|---|

| ACP (Agentic Commerce Protocol) | Stripe, OpenAI, PayPal, Salesforce | ChatGPT checkout, Stripe merchants |

| Trusted Agent Protocol | Visa, Shopify, Microsoft, 5 AI platforms | Cross-platform trust, existing Visa infrastructure |

| Agent Pay | Mastercard, PayPal, IBM | Tokenized transactions, card network security |

Retailers may need to support multiple standards—or find infrastructure partners like Paz.AI that abstract protocol complexity into a single integration layer. The fragmentation problem is real, but it's also solvable.

"This Cyber Week data confirms a complete shift: AI agents are no longer just a cost-saving measure, but an incredible purchase and productivity accelerator in commerce." — Caila Schwartz, Director of Consumer Insights, Salesforce

What Should Retailers Do Next?

The window for first-mover advantage is closing. SAP Emarsys declared that "2025 will likely be the last year consumers shop as they do now"—a stark warning that the current shopping paradigm is ending. Forrester predicts one-quarter of shoppers will use specialty retail chatbots by 2026. The time to prepare is now.

Immediate Actions:

- Audit your AI discoverability: Can ChatGPT, Perplexity, and Google's AI Mode find and accurately describe your products? Amazon's decision to block AI crawlers removed 600 million product listings from AI results and caused their ChatGPT referral traffic to fall 18% month-over-month. Meanwhile, Walmart now captures 20% of ChatGPT referral traffic. If you're blocking AI crawlers, you're blocking revenue. Platforms like Paz.AI can help audit your catalog's AI readiness across every major agent.

- Evaluate payment integration: Contact your payment processor about ACP, Trusted Agent Protocol, and Mastercard Agent Pay support. The infrastructure is surprisingly accessible—Stripe merchants can add ACP support with one line of code. Partners like Worldpay and commercetools are already live. The protocols are available now—not someday.

- Optimize for agent purchase behavior: AI agents don't browse. According to HUMAN Security, 87% of AI agent requests target product pages, but only 2.2% interact with shopping carts or checkout. That gap represents a massive conversion opportunity. Structured data, clear pricing, and instant checkout capabilities matter more than visual merchandising. Google's Shopping Graph now indexes 50 billion+ listings with 2 billion updates per hour—your product data needs to be machine-readable.

- Consider unified infrastructure: Rather than building separate integrations for each protocol, evaluate agentic commerce platforms that handle protocol translation automatically. With ~90% of organizations expected to adopt MCP by end of 2025 and Google's AP2 already backed by 60+ organizations including Mastercard, PayPal, and American Express, the complexity is only growing. Solutions like Paz.AI support ACP, MCP, and emerging standards through a single integration—so you don't have to rebuild when the next protocol launches.

- Future-proof your investment: New protocols will emerge. Google's Agent Payments Protocol (AP2) is already live with select merchants including Wayfair, Chewy, and Quince. Microsoft is deploying Personalized Shopping Agents via Copilot Studio with 1-2 day deployment windows, working with Revolve, Steve Madden, and Rent the Runway. Retailers who build on abstraction layers won't need to re-integrate every time the landscape shifts.

The Cost of Waiting

The performance data is unambiguous. Amazon Rufus users showed 100% higher conversion rates on Black Friday compared to non-Rufus sessions. Shoppers arriving via generative AI were 38% more likely to complete purchases, according to Adobe Analytics. AI visitors spend 32% more time on site with 27% lower bounce rates. Every day without agent integration is revenue left on the table.

Frequently Asked Questions

What is Visa's Trusted Agent Protocol?

Visa's Trusted Agent Protocol is a security framework that enables AI agents to communicate securely with merchants during transactions. It uses cryptographic signatures to verify agent identity, ensure transaction authenticity, and protect consumer data. The protocol is available on GitHub and integrates with existing web infrastructure.

How does Mastercard Agent Pay handle security?

Mastercard Agent Pay uses digital tokenization, generating 16-digit tokens connected to original payment cards. AI agents are registered and verified before transacting on the network. Each transaction is cryptographically secured and traceable, while consumers maintain control over spending parameters and purchase authorization.

Which AI platforms support agentic commerce protocols?

Multiple AI platforms now support agentic commerce. Anthropic, Microsoft, Mistral, OpenAI, and Perplexity are partners in Visa's Trusted Agent Protocol. OpenAI and Stripe created the Agentic Commerce Protocol powering ChatGPT Instant Checkout. PayPal integrates with both ChatGPT and Perplexity.

How much revenue are AI agents influencing?

AI agents influenced $67 billion in global Cyber Week 2025 sales, representing 20% of all orders according to Salesforce. McKinsey projects U.S. B2C agentic commerce will reach $1 trillion in annual revenue by 2030.

What's the performance difference for retailers with AI agents?

Retailers with AI agent capabilities saw 13% sales growth during Cyber Week 2025, compared to just 2% for those without—a 7x performance gap. AI-referred traffic also shows 32% more time on site and 27% lower bounce rates than traditional traffic.

Do consumers trust AI shopping agents?

Consumer trust is evolving. According to Bain & Company research, approximately 50% of consumers remain cautious about fully autonomous AI purchases, while the other half are open to or actively using agentic commerce. The payment networks' security frameworks are specifically designed to address this trust gap.

How do retailers handle multiple agentic commerce protocols?

Protocol fragmentation is a real challenge. Options include building separate integrations for ACP, AP2, TAP, and Agent Pay—or using agentic commerce infrastructure providers like Paz.AI that unify multiple protocols behind a single API. The latter approach reduces engineering burden and automatically supports new protocols as they emerge.

The Bottom Line

Visa, Mastercard, and PayPal don't make simultaneous major product launches by accident. Their coordinated push into agentic commerce signals that the infrastructure for AI-driven shopping is being built now—not in some distant future.

The retailers who integrate with these protocols in 2025 will capture the 7x sales advantage that AI-enabled commerce provides. Those who wait will join the 3% of large retailers who didn't use AI this holiday season—and will serve as case studies in what not to do.

The payment networks have made their bets. The question is whether your business will be ready when their bets pay off.